Derivatmarkedet er et mer eller mindre uregulert uoverisktilg globalt over skanken marked med private derivatavtaler aka veddemål. Dette markedet er 10 ganger så stort som global BNP og blir nå alså sammenblandet med alle sparepenger i det amerikanske banksystemet. JAJA det var det "And its gone"

Du er ikke lenger beskyttet av FDIC fordi 46 milliarder USD i FDIC simpelten ikke dekker in de 4500 milliarder USD i amerikanske bankkontoer. Og FDIC vill ikke få penger av myndighetene aka Bail inn ved neste krise. De FDIC klarete bankavdelingene til de store TBTF bankene kan nå bytte billioner i derivater med sparepenger, og dermed risikere alle penger på konto i disse bankene.

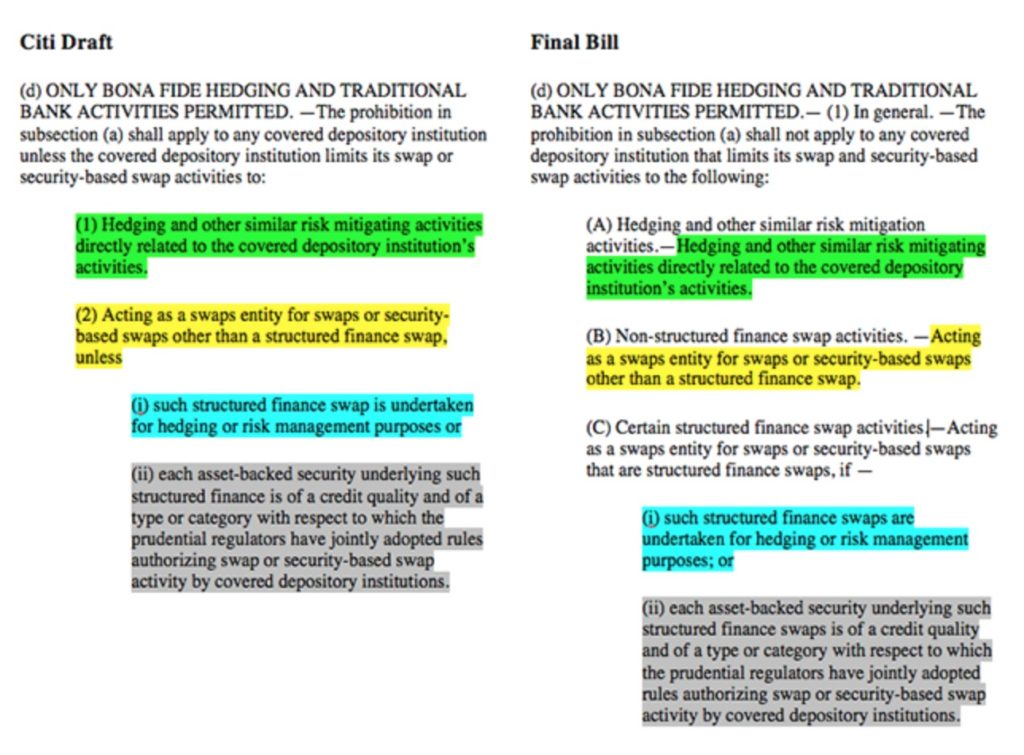

Denne samenblanding sikrer de store bankene tilgang på nesten alle pengene i systemet i en potensiell krise. Istedenfor 18 billioner USD som er USAs statsgjeld sikrer det amerianske folk nå også 300 billioner USD i private veddemål hos TBTF banker i tillegg. Det sykeste er at Citybank mer eller mindre har skrevet reglene selv se under: Mer info her

Flere Just in Time hendelser også i gullmarkedet: Europa, EU og ECB forbereder seg på valutakrise, og refference point gold RPG eller Freegold som jeg kaller det. De siste par år har stadig flere europeiske stater krevet sitt gull tilbake fra utlendighet.Tyskland, Nederland, Obs ikke Sveits, rykter om Belgia, og nå Østerike vil hente hjem gullet sitt. Sist land i Europa gjorde dette var rett før Nixon nektet å levere gull for dollar i August 1971.

ECBs Dragi sa nylig at de hadde vudert alle slags papirer uten om gull ved forrige møte om mulige støttekjøp. Dette er fordi gull er meget viktig for EU/ECB (første post i den konsoliderte balansen til ECB) og må behandles med omhu (gull nevnes feks hele 53 ganger i rapporteringsreglene til ECB fra 2012 se under). EU landene og ECB vil først og fremst sørge for å få tilbake gull som er lagret i utlandet, og kanskje til å med viderelånt.

Monetary Finacial Institutions MFIs(som feks de nasjonale sentralbankene) i EU må redusere gullbeholdningen i balansen sin hvis de har lånt gull, og videresolgt det. Dette for å unngå dobbelt eierskap av gullet. Det vill bli stående i balansen til banken de har lånt gullet fra. Utlån av gull kan også foregå uten sikkerhet eller betaling, og da trenger ikke sentralbankene å nevne det i balansen i det hele tatt!

Deutsche Bundesbank har også nylig innført ny regnskaps metodikk i tråd med IMFs Balance of Payments and International Investment Position Manual (BPM6) (hvor gull nevnes hele 393 ganger!) som inkluderer et krav om å rapportere både uallokerte og allokerte gullbeholdninger.

Her er det mye snusk som må ordnes opp i snarest.

Det er åpenbart dumt å bare ha papirgullreserver når behovet for ekte gull endelig viser seg. Dette skjønner IMF, stadig flere EU land og ECB. Finanskrisen var nokk allikevell en aldrig så liten påminnelse om at det kan være på tide å rydde litt i skapet for å se hva man har.

Gull avfeies og nedtales offentlig men se hva de gjør og du ser hva som skjer. Dvs. USA og EU er snart klare for tidenens største krakk og pengeoverføring.

Her er et noen intressante utdrag om den europeiske sentralbankens regler om håndtering og rapportering av gull. Hentet fra rapporterings reglene til EU landenes sentralbanker April 2012:

REPURCHASE AGREEMENTS, SECURITIES LENDING AND SIMULAR OPERATIONS

The treatment of repurchase operations (repos and reverse repos)1, securities lending against cash collateral, and similar transactions is also discussed in the sections on deposits and loans. Briefly, such transactions are treated statistically as loans against collateral and not as transactions in the security or other instrument involved, which remains on the balance sheet of the original holder. Where an MFI is party to such an operation, it records a deposit liability where it has in effect borrowed cash (the corresponding asset being the cash received), and a loan where it has lent funds against the collateral of the security or other instrument. The recording practice is the same where an MFI (usually an NCB in this case) swaps (lends or borrows) gold against cash, usually in the form of foreign currency deposits. Furthermore, if the entity borrowing the security or other instrument sells it, it should record a negative holding on its balance sheet to avoid double counting (since both the original holder and the purchaser will record the security or other instrument on their balance sheet).

The treatment of repurchase operations (repos and reverse repos)1, securities lending against cash collateral, and similar transactions is also discussed in the sections on deposits and loans. Briefly, such transactions are treated statistically as loans against collateral and not as transactions in the security or other instrument involved, which remains on the balance sheet of the original holder. Where an MFI is party to such an operation, it records a deposit liability where it has in effect borrowed cash (the corresponding asset being the cash received), and a loan where it has lent funds against the collateral of the security or other instrument. The recording practice is the same where an MFI (usually an NCB in this case) swaps (lends or borrows) gold against cash, usually in the form of foreign currency deposits. Furthermore, if the entity borrowing the security or other instrument sells it, it should record a negative holding on its balance sheet to avoid double counting (since both the original holder and the purchaser will record the security or other instrument on their balance sheet).

1 A repurchase agreement (repo) is the sale of securities combined with a binding agreement to buy them back later. A reverse repo is the

purchase of securities combined with a binding agreement to sell them back later. Thus what is a repo for one party to the transaction is

a reverse repo for the other party.

GOLD SWAPS AND GOLD LOANS/DEPOSITS

Gold swaps, which are mentioned briefly in Box 2.1, represent the liability counterpart of cash (usually foreign currency deposits) received by MFIs (in most cases NCBs) in exchange for gold which they have temporarily relinquished, but retain on their balance sheet, under a binding agreement to reverse the transaction at an agreed price and on a specific future date. The treatment is similar to that of repos and also applies to a gold loan against cash collateral. The economic risks and benefits of ownership of the gold (such as the right to holding gains and losses) remain with the original owner (here, the reporting MFI, usually an NCB). The institution lending the gold records the cash received as an asset, with a matching liability in deposits; the institution borrowing the gold records a decline in cash assets and an offsetting increase in loans to the lender.

The statistical treatment of gold swaps (where cash is received in exchange for gold which has been temporarily relinquished) thus differs from the case in which gold temporarily changes hands without collateral, or against a pledge of securities or other non-cash collateral. In these cases, no cash is recorded on the asset side, nor is a corresponding deposit entry made under deposit liabilities. Where no cash is transferred or pledged, the gold swap or loan is not recorded on the balance sheet at all, i.e. it should be treated as an off-balance-sheet operation.

Where the temporary acquirer of gold (under either a gold swap or a gold loan) later sells the gold outright, the sale should be recorded as a transaction in gold and entered on the balance sheet of the temporary acquirer (the short seller) as a negative position in gold. This is to prevent double counting, since the gold will be recorded by both the original owner

Gold swaps, which are mentioned briefly in Box 2.1, represent the liability counterpart of cash (usually foreign currency deposits) received by MFIs (in most cases NCBs) in exchange for gold which they have temporarily relinquished, but retain on their balance sheet, under a binding agreement to reverse the transaction at an agreed price and on a specific future date. The treatment is similar to that of repos and also applies to a gold loan against cash collateral. The economic risks and benefits of ownership of the gold (such as the right to holding gains and losses) remain with the original owner (here, the reporting MFI, usually an NCB). The institution lending the gold records the cash received as an asset, with a matching liability in deposits; the institution borrowing the gold records a decline in cash assets and an offsetting increase in loans to the lender.

The statistical treatment of gold swaps (where cash is received in exchange for gold which has been temporarily relinquished) thus differs from the case in which gold temporarily changes hands without collateral, or against a pledge of securities or other non-cash collateral. In these cases, no cash is recorded on the asset side, nor is a corresponding deposit entry made under deposit liabilities. Where no cash is transferred or pledged, the gold swap or loan is not recorded on the balance sheet at all, i.e. it should be treated as an off-balance-sheet operation.

Where the temporary acquirer of gold (under either a gold swap or a gold loan) later sells the gold outright, the sale should be recorded as a transaction in gold and entered on the balance sheet of the temporary acquirer (the short seller) as a negative position in gold. This is to prevent double counting, since the gold will be recorded by both the original owner

(on whose balance sheet it has remained) and

the new buyer.

EUROSYSTEM ASSETS AND LIABILITIES: THE TREATMENT OF CERTIAN COMPONENTS OF RESERVE ASSETS

Gold 1, SDRs and external claims of the NCB which meet the IMF’s definition of reserve assets in terms of liquidity, ready availability for use, and credit standing of the debtor, constitute external reserves. These external claims will typically include substantial assets denominated in foreign currencies, representing claims on non-residents, typically central banks, other MFIs or governments. For euro area countries, cross-border claims within the euro area (irrespective of the currency of denomination) and claims denominated in euro are not reserve assets, irrespective of the identity of the debtor.

The ECB publishes monthly data on reserve assets of the Eurosystem as part of the balance of payments and international investment position of the euro area. 2 The MFI balance sheet reporting framework for NCBs, however, does not include a position called reserve asset instruments. Rather, monetary gold is recorded in a dedicated sub-item, and holdings of SDRs together with other asset positions vis-à-vis the IMF are reported in the item “receivables from the IMF”. The ECB does not show these items separately in published MFI balance sheet statistics, but includes them indistinguishably in MFIs’ external assets (see also Section 4.1).

Receivables from the IMF represent the asset position a member country holds vis-à-vis the Fund. In accordance with the IMF’s definition, these receivables consist of (a) the “reserve tranche”, i.e. any foreign currency holdings (including SDRs) that a member country may draw at short notice, (b) any debt of the IMF (under a loan agreement) in the General Resource Account, the General Arrangements to Borrow and the New Arrangement to Borrow, and (c) any existing claims arising from contributions to trusts, such as the one related to the Poverty Reduction and Growth Facility (formerly ESAF). (a) and (b) correspond to the reserve position vis-à-vis the IMF in balance of payments and international investment position statistics.

As regards the valuation of monetary gold and receivables from the IMF, the former should be valued at its market price on the balance sheet date. Receivables from the IMF are denominated in SDRs and should be converted into euro at the rate published by the IMF on the balance sheet date.3 SDRs are issued without charge. To balance the holdings of SDRs a notional accounting entry (called “counterpart to IMF special drawing rights”) is made in remaining liabilities (not in

Gold 1, SDRs and external claims of the NCB which meet the IMF’s definition of reserve assets in terms of liquidity, ready availability for use, and credit standing of the debtor, constitute external reserves. These external claims will typically include substantial assets denominated in foreign currencies, representing claims on non-residents, typically central banks, other MFIs or governments. For euro area countries, cross-border claims within the euro area (irrespective of the currency of denomination) and claims denominated in euro are not reserve assets, irrespective of the identity of the debtor.

The ECB publishes monthly data on reserve assets of the Eurosystem as part of the balance of payments and international investment position of the euro area. 2 The MFI balance sheet reporting framework for NCBs, however, does not include a position called reserve asset instruments. Rather, monetary gold is recorded in a dedicated sub-item, and holdings of SDRs together with other asset positions vis-à-vis the IMF are reported in the item “receivables from the IMF”. The ECB does not show these items separately in published MFI balance sheet statistics, but includes them indistinguishably in MFIs’ external assets (see also Section 4.1).

Receivables from the IMF represent the asset position a member country holds vis-à-vis the Fund. In accordance with the IMF’s definition, these receivables consist of (a) the “reserve tranche”, i.e. any foreign currency holdings (including SDRs) that a member country may draw at short notice, (b) any debt of the IMF (under a loan agreement) in the General Resource Account, the General Arrangements to Borrow and the New Arrangement to Borrow, and (c) any existing claims arising from contributions to trusts, such as the one related to the Poverty Reduction and Growth Facility (formerly ESAF). (a) and (b) correspond to the reserve position vis-à-vis the IMF in balance of payments and international investment position statistics.

As regards the valuation of monetary gold and receivables from the IMF, the former should be valued at its market price on the balance sheet date. Receivables from the IMF are denominated in SDRs and should be converted into euro at the rate published by the IMF on the balance sheet date.3 SDRs are issued without charge. To balance the holdings of SDRs a notional accounting entry (called “counterpart to IMF special drawing rights”) is made in remaining liabilities (not in

-

1 As noted above, gold held by a central bank is normally classified as monetary gold, and is a financial asset, whereas gold held

by anyone else (including other MFIs) is treated statistically as a commodity, and thus as a non-financial asset, and is included in

“fixed assets”.

-

2 See Section 7 of the statistical chapter of the ECB’s Monthly Bulletin.

-

3 See the IMF’s website (http://www.imf.org).

Ingen kommentarer:

Legg inn en kommentar